Market Insights

AI-powered analysis and insights for agricultural commodity markets and supply chains.

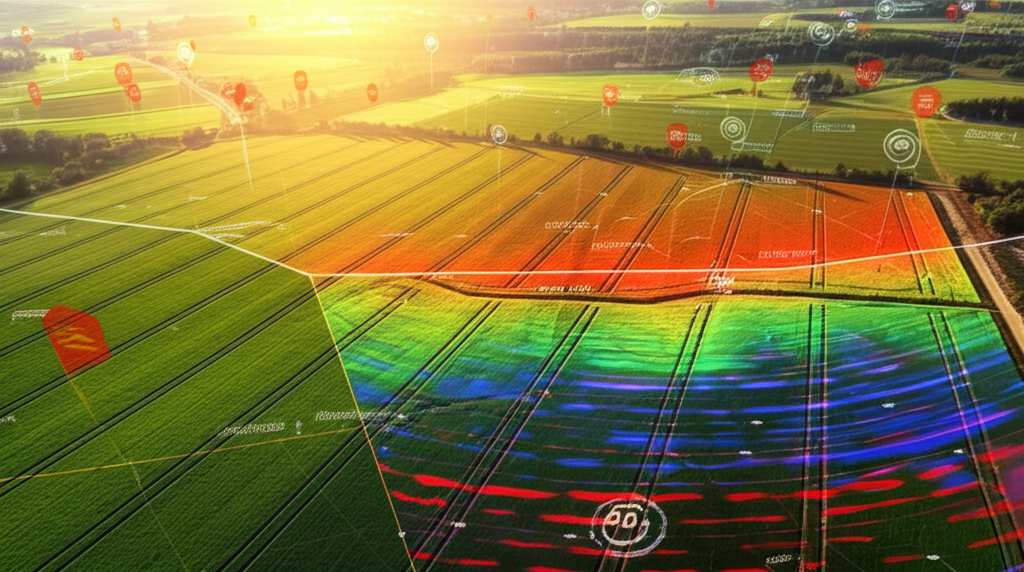

AI-Powered Agricultural Market Insights

Leverage advanced artificial intelligence to gain deeper understanding of global agricultural markets, supply chains, and trading opportunities.

Supply Chain Insights

Understanding agricultural supply chains and their impact on commodity markets.

Recent port congestion in Asia has increased shipping times by 37%, affecting grain exports from major producing regions. Our AI analysis predicts continued disruptions through Q3 2025, with wheat and soybean prices experiencing the most volatility.

Global wheat inventories are currently 8% below the five-year average, with particularly low levels in North Africa and the Middle East. This supply constraint, combined with increased demand from emerging markets, suggests bullish price pressure through 2025.

Market Trends

Emerging patterns and shifts in global agricultural commodity markets.

Livestock Markets

Feeder cattle prices have increased 12% year-over-year due to reduced herd sizes in major producing regions. Drought conditions in the western United States continue to pressure producers, with limited pasture availability driving higher feed costs.

Grain Markets

Black Sea wheat exports have recovered from recent geopolitical disruptions, increasing global supply and pressuring prices. However, quality concerns from excessive rainfall in Europe have created a two-tier market with premium prices for high-protein wheat.

AI Market Analysis

Advanced artificial intelligence insights on agricultural markets.

Correlation Discovery

Our AI has identified a previously undetected 78% correlation between Brazilian soybean futures and Southeast Asian palm oil prices with a 3-week lag, creating potential arbitrage opportunities.

Weather Pattern Impact

AI analysis of satellite imagery and weather data indicates a 65% probability of above-average rainfall in key corn-growing regions of the U.S. Midwest during the critical pollination period, suggesting potential yield improvements.

Supply Chain Disruption Prediction

Based on analysis of shipping data, port congestion metrics, and historical patterns, our AI predicts a 40% probability of significant supply chain disruptions affecting grain exports from the Gulf Coast in Q3 2025.

AI Trading Recommendation

Based on current market conditions and AI analysis, consider long positions in high-protein wheat futures with a 60-day horizon, and implement a calendar spread strategy for corn to capitalize on anticipated weather-driven yield improvements.

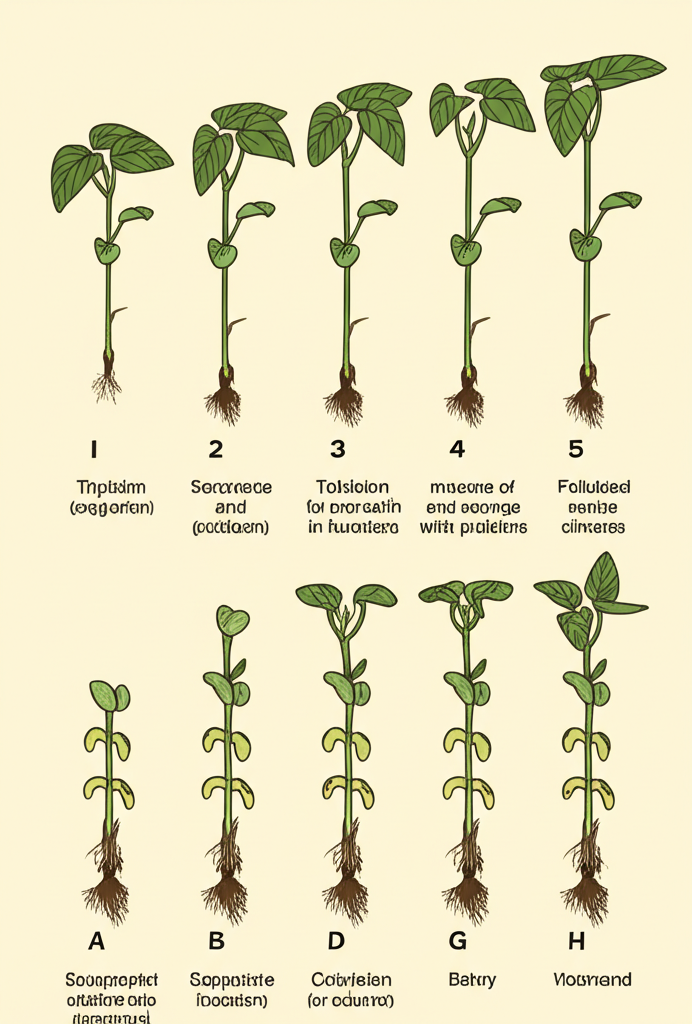

Seasonal Patterns

Key seasonal events and their impact on agricultural markets.

April-May

Corn Planting

June-July

Wheat Harvest

August-September

Soybean Development

October-November

Corn/Soybean Harvest

Trading Strategy

Historical analysis shows that purchasing corn call options 60 days before planting season and selling 30 days after planting completion has yielded positive returns in 7 of the last 10 years due to weather premium expansion.